How to measure Meta correctly? Part 2: Add offline sales impact

Most performance marketing teams are not measuring the full impact of their Meta campaigns. Majority of cross-channel measurement is still done with click-based attribution, which significantly under-reports the ROI of Paid Social, including Meta.

In the the first part of our blog series on measuring Meta correctly, we found out that last-click reported eCommerce revenue impact of Meta needs to be multiplied by 2-9x to arrive at true Meta-driven eCommerce sales measured with Marketing Mix Modeling (MMM).

Even worse, click-based attribution is not measuring how Meta drives sales in physical stores. It only focuses on eCommerce sales, which can be 10-20% of the total business for omnichannel retailers, leaving majority of the business unmeasured.

This article is part 2 of our blog post series on how Marketing Mix Modeling helps measuring the full impact of Meta. Marketing Mix Modeling is an approach that reveals the true incremental sales impact of all Paid Social channels, including their contribution to eCommerce sales and physical store sales. Contrary to attribution, Marketing Mix Models use real daily eCommerce and offline sales data and is based on time-series analysis.

Example: Measuring the full impact of Meta Advantage+

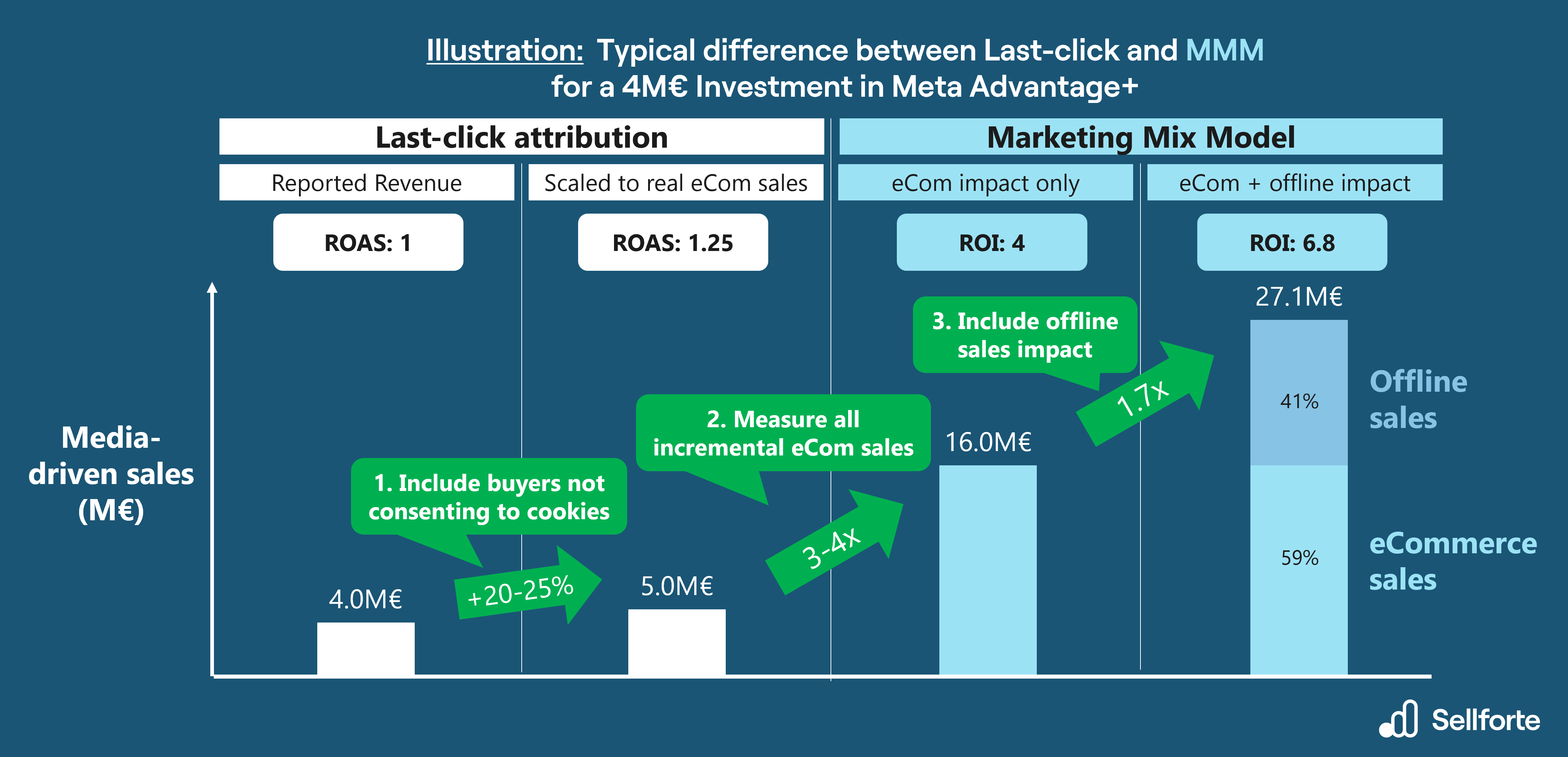

To illustrate measuring the full impact of Meta, let's use an example of a retailer with both eCommerce and physical store sales. The retailer has invested 4M€ into Meta Advantage+. The marketing team wants to understand the total ROI of their Meta Advantage+ campaigns, as well as how much sales was driven with the investment.

As a starting point, let's assume last-click is reporting ROAS of 1.0 for the 4M€ Advantage+ investment, suggesting it was driving 4M€ of sales.

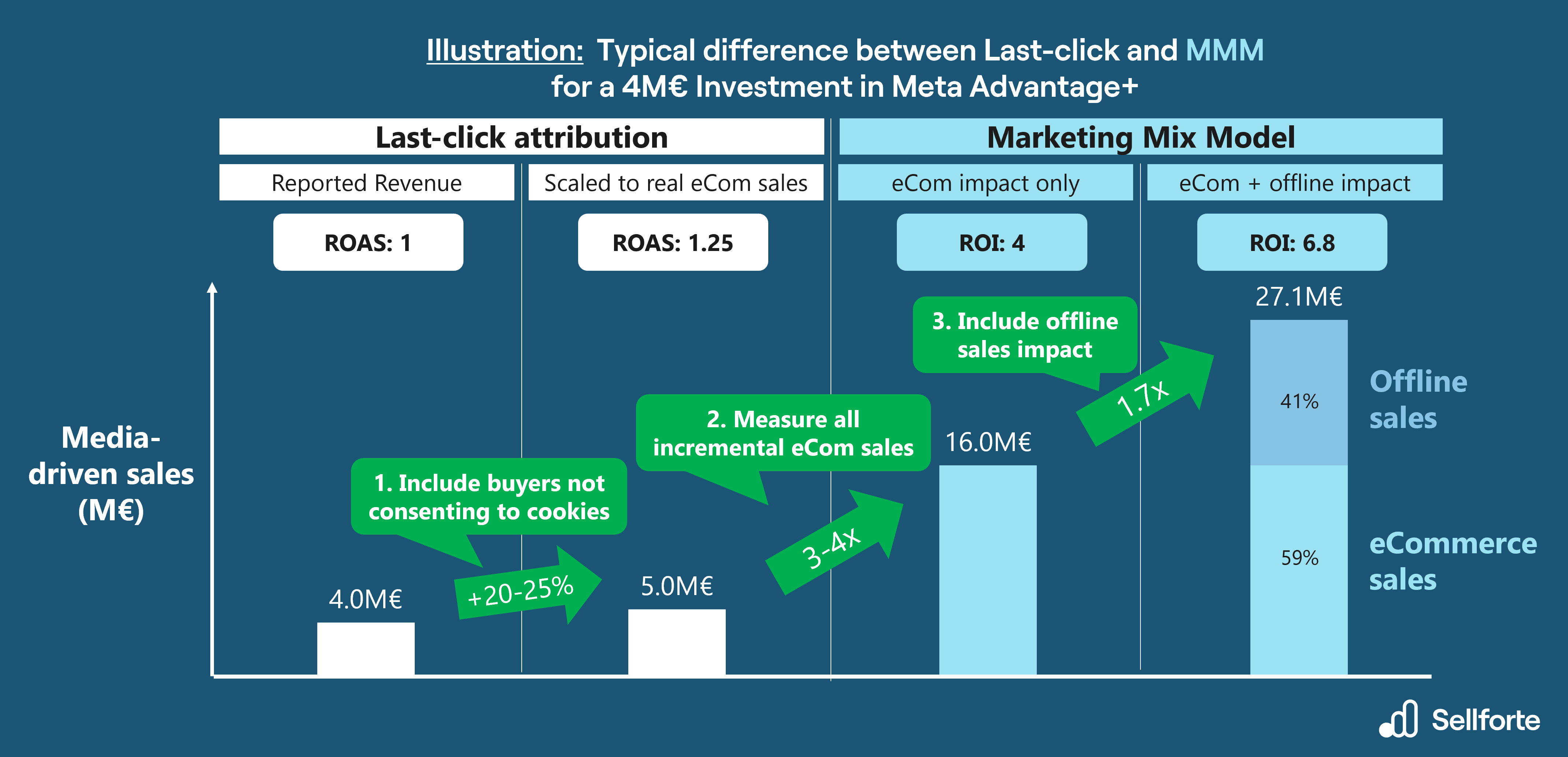

Next, let's walk through the three levers (summarized in the picture below) how the marketing team can get closer to understanding the full impact of the investment.

The multipliers in each lever are based on Sellforte research. However, the exact ROAS / ROI levels in this example are illustrative (but still in the ballpark what you might see in the real world).

Illustration: Measuring the full impact of Meta Advantage+

Illustration: Measuring the full impact of Meta Advantage+1. Include buyers not consenting to cookies

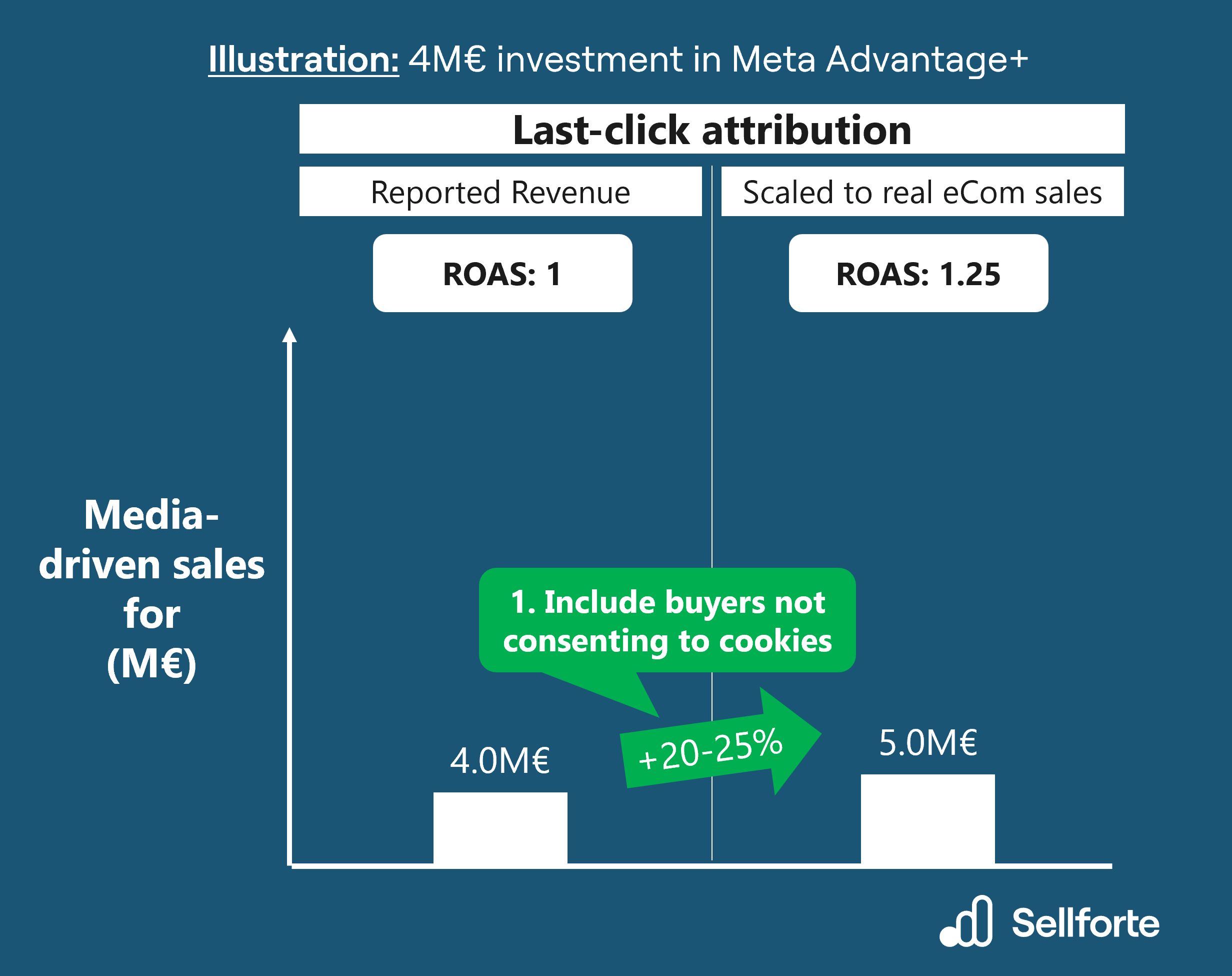

When comparing real eCommerce sales and total revenue reported by an attribution tool (e.g., Google Analytics 4), we typically see that real eCommerce sales is 20-25% higher than total revenue reported by the attribution tool. You can easily calculate the actual percentage to your business by comparing your total eCommerce sales and total revenue from your attribution tool. This difference is driven by the fact that click-based attribution is primarily operating with analytics cookies that the website visitor has to accept when entering the website. Due to the privacy trend, cookie consent has been declining for some time already.

To fix the cookie data gap with a crude approximation, we can add the missing 20-25% to the 4M€ attribution-reported revenue. By doing this, we are scaling reported revenue to real eCommerce sales, taking us to 5M€ of media-driven sales. This means the ROAS has increased from 1.0 to 1.25, as is illustrated in the picture below.

However, as we see in the next levers, this lever does not really fix the inherent problems with click-based attribution - it's just fixing the cookie data gap.

Scaling last-click attribution to full eCom sales

Scaling last-click attribution to full eCom salesNote: Attribution and website analytics tools have methods that try to attribute sales also for the buyers not consenting to analytics cookies, but we have not (at least yet) seen them work well enough to bridge the gap of 20-25% to real eCommerce sales. These methods include for example retaining the traffic source UTM tag at the end of the URL for each page the users visits (breaks down easily when user navigates in the store), and different methods that combine non-cookie-dependent session identification methods with storing session data server-side.

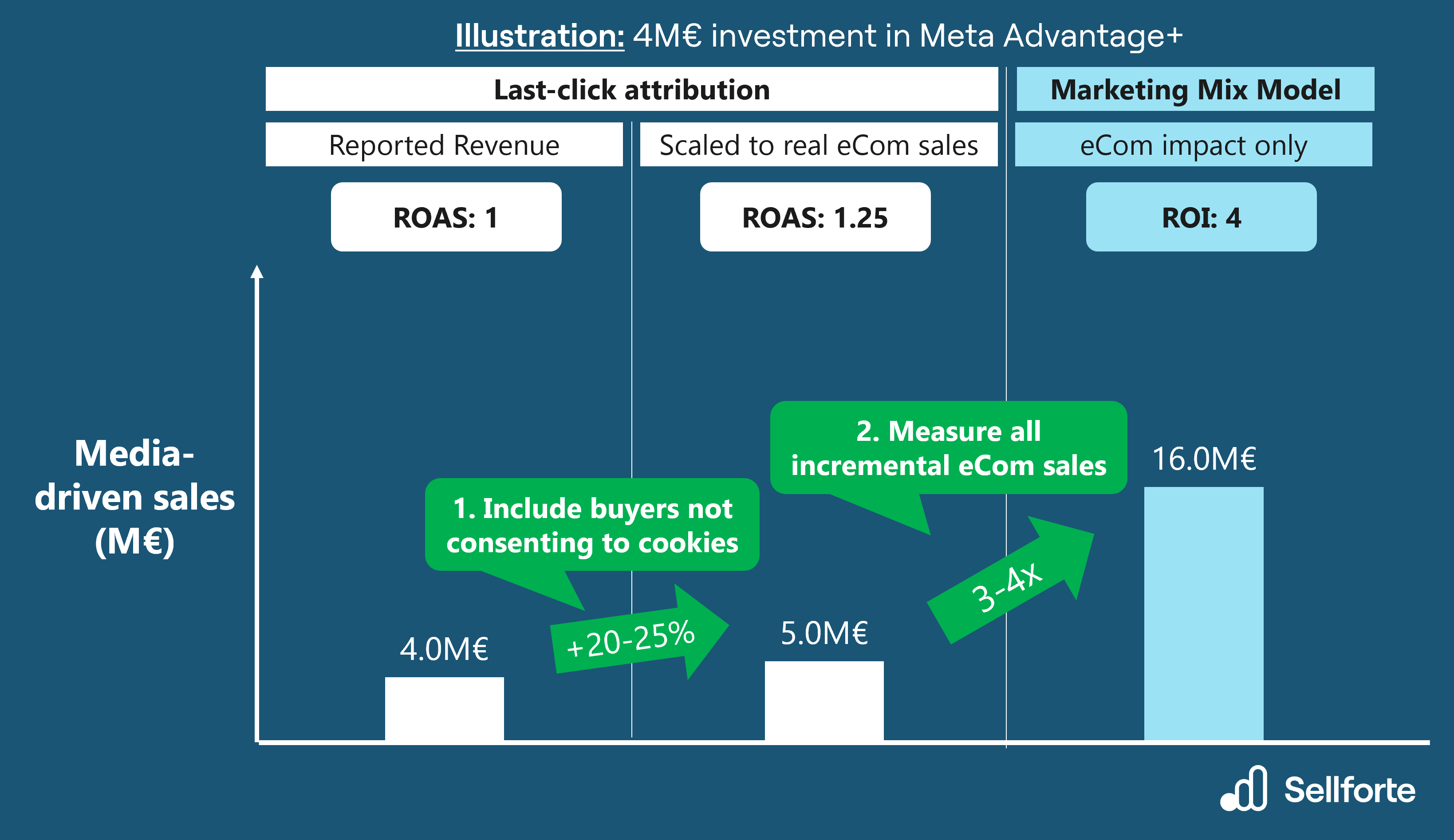

2. Measure all incremental eCom sales with MMM

Marketing Mix Modeling is required to implement this lever, where we start measuring all incremental eCommerce sales driven by Meta.

Let's first look at the typical differences between last-click-reported ROAS and MMM reported ROI for eCom sales. In part 1 of this article series on Meta, we found out that last-click-reported ROAS needs to be multiplied with 1.6 - 9.2x, depending on Meta channel, to arrive at Meta's real eCommerce sales impact. The multiplier is

- Highest for awareness campaigns, for which last-click typically attributes very little revenue.

- Lowest for retargeting campaigns to returning customers, where last click captures more revenue compared to awareness

The median values from the study are summarized below (we recommend to get introduced to the original study):

Typical multipliers from last-click ROAS to MMM ROI for Meta channels

Typical multipliers from last-click ROAS to MMM ROI for Meta channelsWhen our example company adopts Marketing Mix Modeling, it learns that the real eCom sales driven by Advantage+ is 16M€ with ROI of 4, as illustrated below.

Typical increase for Meta Advantage+ eCommerce sales impact when adopting MMM

Typical increase for Meta Advantage+ eCommerce sales impact when adopting MMMNote: The multipliers from the study referred above had attribution-tool reported revenue (i.e. not scaled) as the starting point. This is why we multiplied 4M€ by 4x (multplier for Advantage+), which equals 16M€.

3. Include offline sales impact

Marketing Mix Modeling is required also to implement this lever: adding offline sales impact of Meta. This lever is relevant for companies with both eCommerce sales and physical store sales.

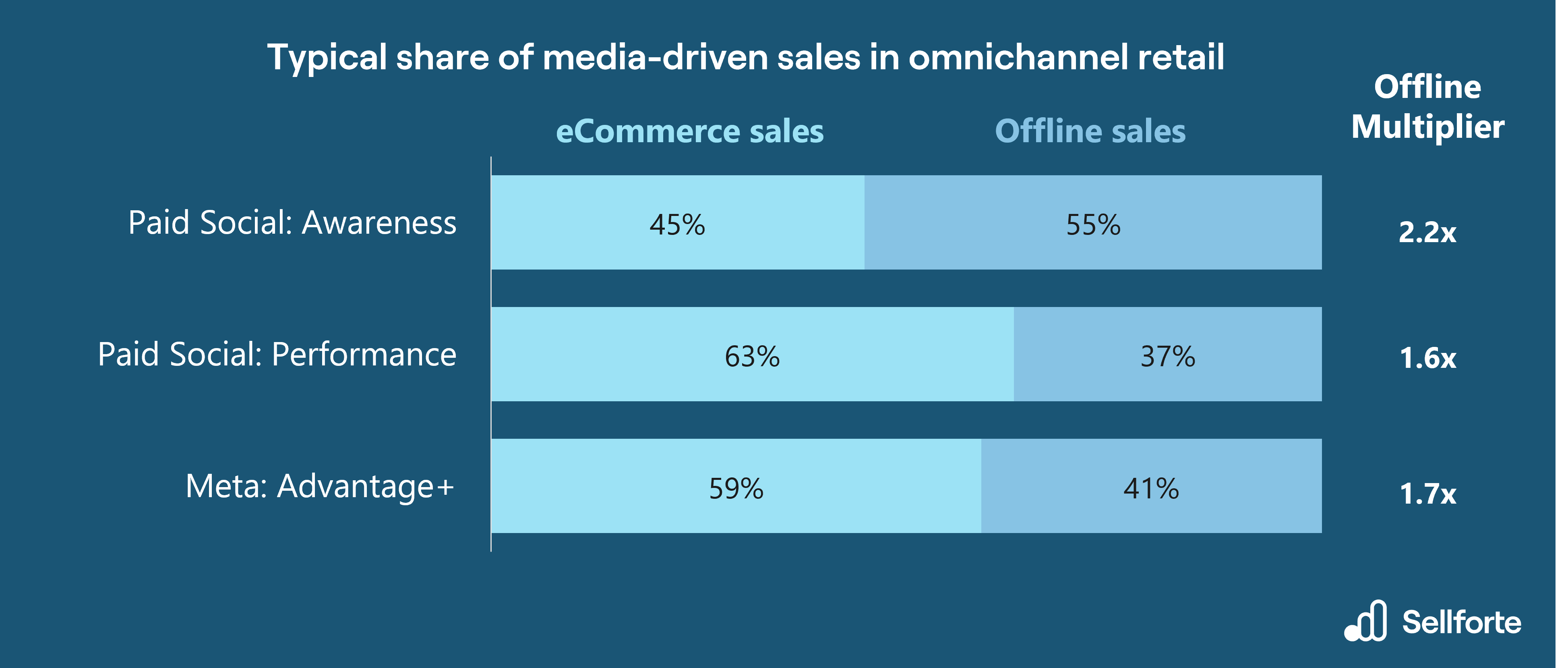

After analysing a sample of 96 Marketing Mix Models from different retail industries, we found out that on average offline sales impact's share out of the full sales impact of a channel is approximately

- 55% for Paid Social awareness campaigns

- 37% for Paid Social performance campaigns in general (this includes prospecting, retargeting and so on)

- 41% specifically for Meta Advantage+

The percentage of offline sales impact is higher for retailers with larger share of offline sales, and lower for retailers with smaller share of offline sales.

These figures can also be summarized into "offline multipliers", i.e. what is the multiplier to apply to media-driven eCom sales to arrive at full sales impact that also includes offline sales. As an example, for Meta Advantage+ this mutlpilier is 1.7x. The picture below illustrates these figures

Typical share of media-driven sales in omnichannel retail for Paid Social

Typical share of media-driven sales in omnichannel retail for Paid SocialAfter applying the multiplier of 1.7x to our example, we arrive at the full sales impact of our Meta Advantage+ investment, as illustrated in the picture below.

When looking at the final outcome, we see that full impact of Meta Advantage+ is 6.8x compared to last-click:

- We started from 4M€ of Attributed Revenue, but MMM revealed that the total sales impact 27.1M€.

- We started from a ROAS of 1.0 and arrive at the full ROI of 6.8.

Measuring the full impact of Meta Advantage+

Measuring the full impact of Meta Advantage+Conclusion: What does this mean for marketers?

- If your current measurement approach is based on last-click attribution, you are undervaluing Meta, and Paid Social channels in general

- Use Marketing Mix Modeling to reveal the true incremental eCommerce sales and offline sales driven by Meta

Curious to learn more? Book a demo.

You May Also Like

These Related Stories

What is Marketing Mix Modeling (MMM)? A Complete Guide for Marketers

The 3 Danger Zones of Last-Click (And How to Avoid Them)

.png)